social security tax limit 2022

If a couple is married each person. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

In 2021 the threshold was 18960 a year.

. During the year you reach full retirement age the SSA will withhold 1 for every. If a couple is married each person would have a 147000 limit. 9 rows En español.

The OASDI tax rate for wages in 2022 is 62 each for employers and employees. We call this annual limit the contribution and benefit base. Ad Discover The Traditional IRA That May Be Right For You.

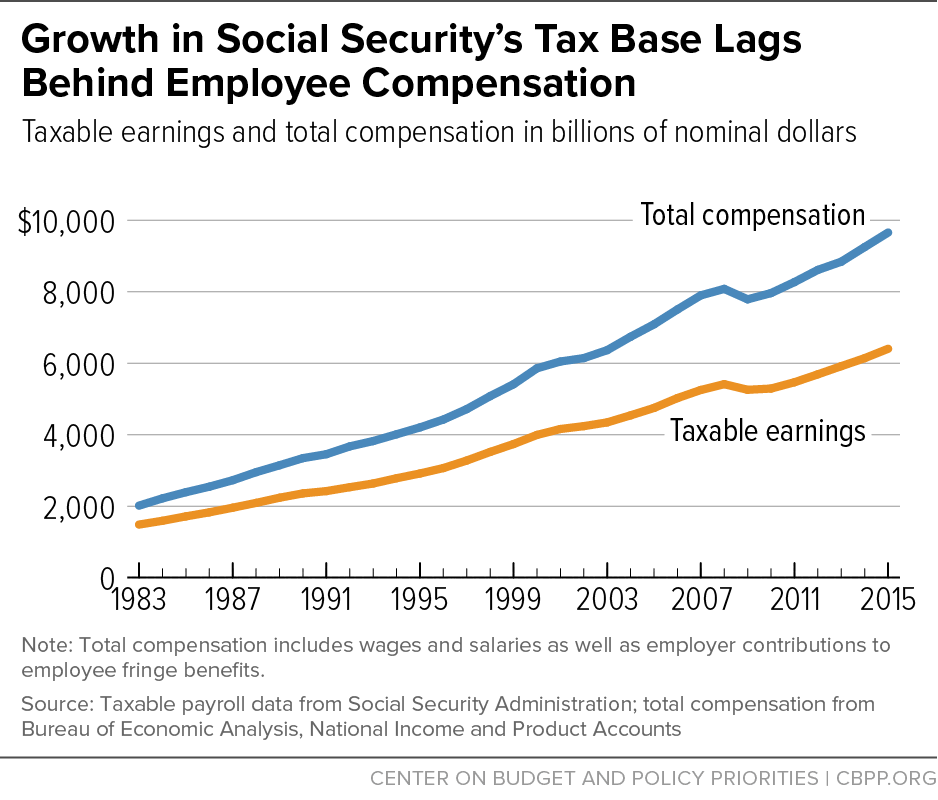

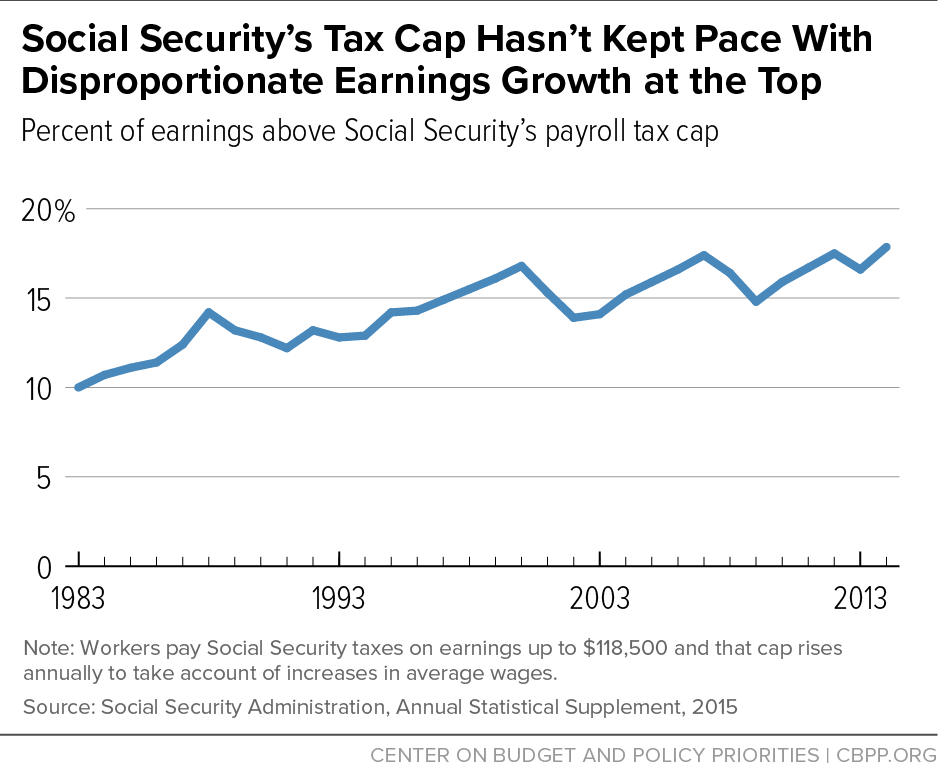

Increase the taxable maximum such that 90 percent of earnings are subject to the payroll tax phased in 2022-2031. The exception to this dollar limit is in the calendar year that you will. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see.

1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000 up from the 142800 maximum for 2021 the. If you file an individual federal tax return and your combined income is between 25000 and 34000 you may have to pay taxes on up to half of your Social Security benefits. New Bill Could Give Seniors an Extra 2400 a Year.

That means an employee. For 2022 the maximum limit on earnings for withholding of Social Security old-age. Fifty percent of a taxpayers benefits may be taxable if they are.

For SE tax rates for a prior year refer to the Schedule SE for that year. The amount increased to 147000 for 2022. You must withhold 62 from each employees wages.

The Social Security employer contribution. The wage base limit is the maximum wage thats subject to the tax for that year. In addition apply a tax rate of 62 percent for earnings above the.

This amount is known as the maximum taxable earnings and. For every 2 you exceed that limit 1 will be withheld in benefits. The Social Security tax withholding rate is 62.

Filing single head of household or qualifying widow or widower with 25000 to 34000 income. For earnings in 2022 this base is. All your combined wages tips and net earnings in the current year.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Unlike many other tax cap limits this stands as an individual limit. Only the social security tax has a wage base limit.

That threshold will rise to 19560 a year in 2022. The 765 tax rate is the combined rate for Social Security and Medicare. Social Security tax rate.

Learn About Contribution Limits. The OASDI tax rate. The rise in the social security payroll tax threshold from 127200 in 2017 to 147000 in 2022 indicates a 156 percent increase.

For earnings in 2022 this base is 147000. This amount is also commonly referred to as the taxable maximum. But this number is also tied to changes in.

Social security payroll tax limit for 2022. Luckily most states dont tax Social Security currently 37 of them to be exactBut the number of states that tax Social Security will decrease by one in 2022 when West Virginia residen. 1 day agoThe 62 OASDI tax which funds various Social Security programs applies only to the first 147000 of a workers earnings for 2022.

If you are working there is a limit on the amount of your earnings that is taxed by Social Security. For 2022 the Social Security earnings limit is 19560.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

How Can I Figure Out My Payroll Taxes In 2022 Payroll Taxes Payroll Tax

Social Security Washington Leaders At Odds Over Proposed Tax Increases

Both Centre And State Government In 2022 State Government Government Social Security Benefits

What Is Fica Tax Contribution Rates Examples

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age